Guin began his career in software sales, but now works in a strategy role at a large telecom firm, which he transitioned to after earning an executive MBA at the Indian Institute of Management, Ahmedabad. He discovered the FIRE movement on social media in 2018, but his interest deepened during the covid pandemic in 2020.

“The idea of being financially independent and retiring early to do what I truly love was very appealing,” says Guin. According to him, FIRE isn’t about quitting work but gaining the freedom to pursue passions. “For me, FIRE doesn’t mean just kicking back and relaxing in a shack on a beach. I might explore entrepreneurship or teaching, which I’m passionate about. I would like to think how I can give back to society,” he says.

“As a child, I have witnessed financial uncertainty. Perhaps that’s also a reason to seek FIRE,” Guin adds.

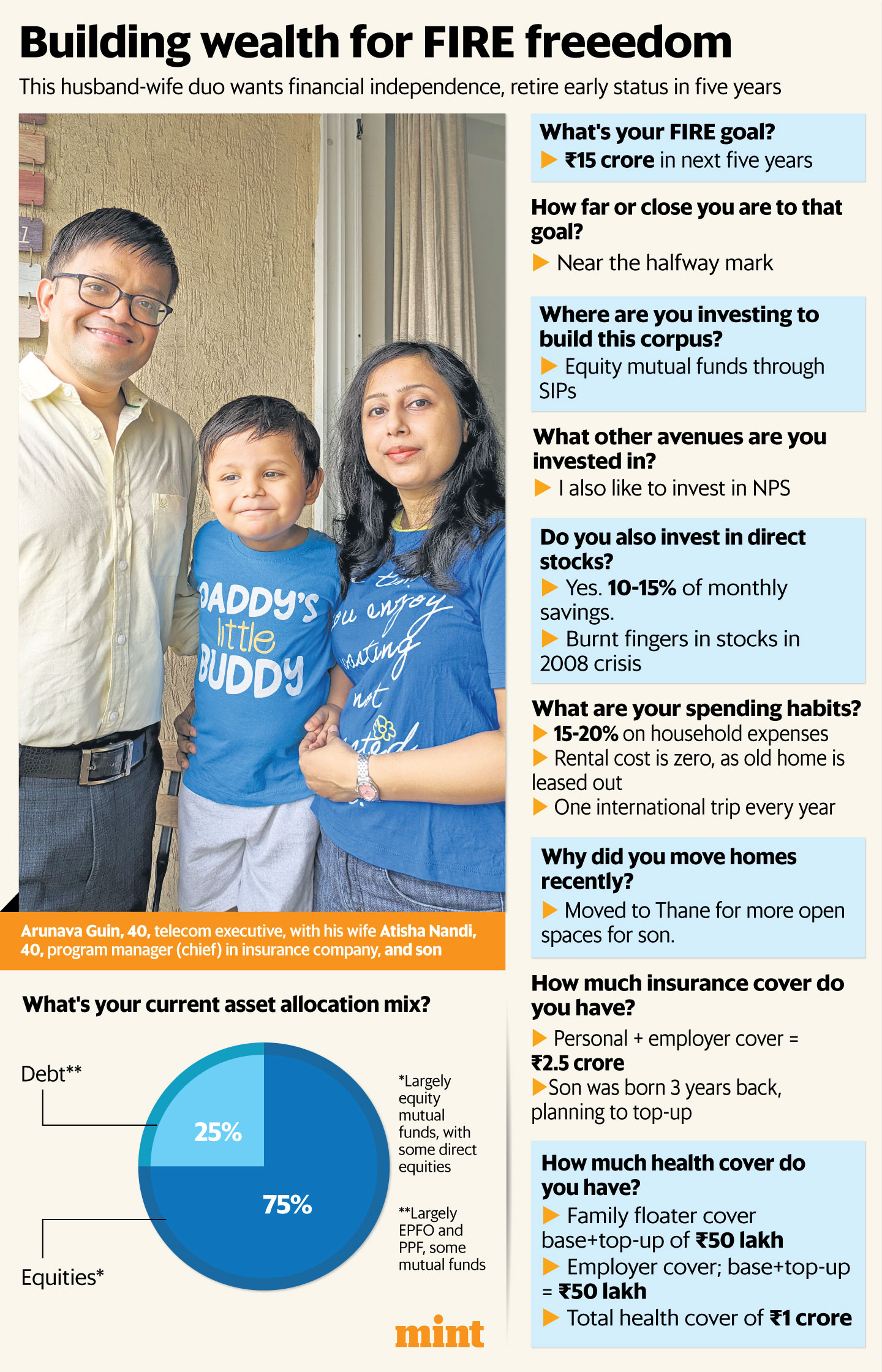

To accelerate his FIRE journey, Guin restructured his investment portfolio over the years. Here is a look at it.

View Full Image

Minimizing mutual funds

Guin was first exposed to the stock markets in the late 2000s, when he began buying direct stocks. However, the experience wasn’t a good one, and he recalls holding some prominent stocks that, after the 2008 crisis, either became penny stocks or were delisted. “I have burnt my fingers in the stock markets. I had bought these stocks based on tips from colleagues or friends,” he says.

Later, a work colleague introduced Guin to mutual funds, which became the core of his portfolio. Over time, his mutual fund portfolio grew very large and needed to be streamlined, which he began doing about three years ago. At one point, the portfolio spanned over 60 schemes, which he attributes to the numerous new fund offers launched in 2009 when he first started investing, He has now brought this down to a more manageable 20-25 schemes.

“Back then, many PSU (public sector unit) funds, thematic funds and large-cap funds were being launched, and as a newbie, I ended up buying several,” he recalls.

Guin’s strategy is straightforward: On strong market days, he sells some of his investments, and on weaker days, he reallocates them into his preferred funds. These are funds he already own, thus consolidating his portfolio.

And he has found valuable guidance online. “I used Value Research and noticed significant overlaps in my funds, like HDFC and Reliance Industries stocks appearing multiple times. That was eye-opening,” he says.

Despite his efforts, Guin’s portfolio will remain at around 15-20 schemes due to tax implications. “Trimming or exiting funds triggers taxes, so reducing further isn’t tax efficient. Ideally, experts say you need just 5-6 schemes, but for now 15-20 is where I’ll stay,” he says.

Asset mix

Guin’s portfolio consists of 75% exposure to equities, largely through mutual funds, and 25% to debt. The debt exposure includes some mutual funds, but largely Employees’ Provident Fund (EPF) and Public Provident Fund (PPF). While he still invests 10-15% of his monthly savings in direct stocks, mutual funds form the core of his portfolio.

Over the years, Guin has consistently built his mutual fund portfolio through systematic investment plans (SIPs), allowing him to invest a fixed amount every month. And as his income has grown, he has increased his monthly SIP allocation.

Guin dismisses real estate as a viable investment for his portfolio size. “Real estate makes sense for portfolios of ₹50-100 crore, but not for those under ₹10 crore,” he says. He also avoids gold and bank fixed deposits.

Guin has been diligently investing in PPF for several years. In recent years, he has been investing up to the ₹1.5 lakh annual limit. Additionally, his current employer contributes 10% of his basic salary to the National Pension Scheme (NPS). “My previous organizations didn’t offer this, but my current one does,” he notes. Separately, Guin has been contributing ₹50,000 annually to the NPS, fetching him an additional tax benefit.

Relocating

Until recently, Guin had lived his entire life in Mumbai (barring the time spent in Ahmedabad pursuing an MBA). But in 2021, he decided to shift out of India’s financial capital as he wanted a larger home and open spaces for his family, especially spaces where his baby boy could explore and grow. Guin found a gated community in Thane, featuring wider roads, spacious walking areas and other amenities.

Interestingly, the shift to Thane is not costing Guin anything. When he moved there, he rented out his suburban Mumbai home. “The two rents are essentially the same, so they cancel each other out. My rental cost is nil, and I’m much happier with the infrastructure and quality of life here,” he says.

Guin was very clear that he didn’t want to buy another house, as the numbers didn’t add up for him. At the time, he was working from home. But now that he’s back to working from the office, he manages the long commute to Mumbai’s Bandra Kurla Complex by avoiding peak traffic hours.

Other goals

Guin has also factored the education costs of his son into his FIRE target but acknowledges the need for flexibility. “Education is a very dynamic scenario,” he says. “My elder sister, an engineer, graduated in 1999, and her entire education cost ₹16,000. I paid ₹14,000-15,000 annually for my engineering seat in Mumbai. Today, an engineering education costs lakhs in India, and even higher abroad.”

“While ₹12-15 crore (his FIRE target) should also cover his education expenses, we have to be open to the idea that it may change drastically. We may end up spending much more or much less,” Guin says, noting that his son is just three years old now. “We really don’t know how the future is going to pan out.”

Spending habits

Guin and his wife spend 15-20% of their joint income every month on household expenses. He says his wife is also on the FIRE journey with him, and the targeted FIRE corpus is estimated to take care of both their expenses.

As mentioned, the family’s rental costs are zero, since the rent from his leased-out property accounts for the rent of his current house. He says their household expenses are low, and they don’t curb their expenses as such.

“We both love travelling, so our major expenses go towards that,” he says. They usually take one international trip a year. “We hope to add one or two more trips within India,” he adds.

Their philosophy is to make the most of their international travels while they are working and have good jobs. “When we retire, we’ll focus more on exploring India,” Guin says.

As they age, Guin says travelling will get challenging. “It’s harder to travel as you get older. A typical European city might require 20,000-25,000 steps a day. You might not be able to do that once you’re over 50,” he notes. “You’ll need cars everywhere, and India is better for that.”

Insurance

Guin maintains his own term insurance, aside from the coverage provided through his employer, amounting to a total of ₹2.5 crore. “Since my child was born, I have been considering topping up my term insurance. I may do so this year,” he says.

Reflecting on insurance strategy, he states, “Insurance should only cover the period you plan to be earning. I plan to work until around 45 or 50. Possibly, I may stop paying for the insurance cover beyond that.”

Currently, Guin pays a higher premium of ₹8,000-10,000 for his term cover. “I took it long back, so my premiums are a bit higher,” he says.

Guin’s family has health insurance cover of around ₹1 crore. Company-provided insurance covers both him and his spouse. Additionally, he has insured his mother through his company, as he says that outside of corporate plans, the health cover products for senior citizens are not that good.

“There are plans, but with all the disclaimers and terms, they’re not great. So, I cover my mother through my corporate insurance,” he explains. “For my wife and child, I’ve added a family floater cover with a top-up. We’re insured up to ₹50 lakh with the base and top-up.”

Guin adds, “Both me and my wife get separate health covers from our offices. Put together, with base and top-up, these covers are ₹50 lakh or thereabouts. So, all put together, we have about a crore in health insurance coverage.”